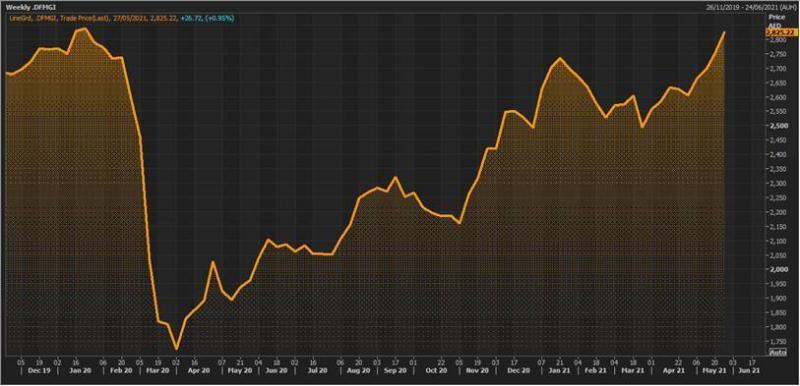

**Dubai Financial Market:** The general index rose by about 1% on Wednesday, closing above 2800 points for the first time in nearly 16 months. The main support came from the leading bank stocks, particularly Emirates NBD, which surged about 5% to reach its highest level since January of the previous year. Additionally, Dubai Islamic Bank rose for the eighth consecutive session, reaching its highest point in over three months. Ziad Al-Qaimari, a member of the American Academy of Financial Management (AAFM), explained to CNBC Arabia during the Market Path program that the transfer of buying liquidity from real estate stocks, which had supported the market index in the past period, to banking leaders in the last two sessions helped elevate Dubai's index to these levels, especially since the weights of Dubai Islamic Bank and Emirates NBD exceed 35% of the index.

**Abu Dhabi Financial Market:** The general index declined from its all-time high, losing levels of 4600 points after profit-taking prevailed over various leading stocks during Wednesday's trading, particularly those that had risen to historic levels, such as First Abu Dhabi Bank, which fell by more than 2% after reaching 17 dirhams for the first time in its history in the previous session.

**Qatar Stock Exchange:** The general index continued its rebound into the green zone for the second consecutive session, following a series of daily declines that brought the index down to 10500 points after foreign selling operations followed the semi-annual review of the MSCI index. Several stocks shone on the Qatar Stock Exchange on Wednesday, such as Salam International, which jumped to its highest levels in nearly four years, and Investment Holding, which rose to the maximum without any major news about the company.

**Kuwait Stock Exchange:** The first index at the Kuwait Stock Exchange lost levels of 6800 points, declining by about 0.4%. The index had breached these levels on May 17 for the first time in nearly 14 months. Several leading stocks pressured the index during Wednesday's session, including Boubyan Bank, Mabanin, and Kuwait Bank, which fell by 0.1%, 1%, and 0.9% respectively.

**Saudi Market:** The Saudi market continued its rise for the second consecutive session with the increase of several leading stocks in the petrochemical and healthcare sectors, while bank stocks faced profit-taking after a wave of record gains. The main index closed up by about 0.23% at 10471.5 points, near its highest levels in nearly a month, with liquidity reaching 9.3 billion riyals. Suliman Alhabib's stock rose by about 5% in high trading volume, closing at its all-time high. However, leading bank stocks, led by the National Commercial Bank and Al-Rajhi, fell, while Riyad Bank's stock rose by about 1%.

**Egyptian Stock Exchange:** Selling pressures on the Egyptian Stock Exchange continued for the third consecutive session, with heavy selling on Commercial International Bank, which has the largest relative weight within the index, declining by about 4.25% to its lowest levels since mid-April. The main index of the market closed down by about 1.5% near its lowest levels in almost a month, while the EGX70 index rose by about 2% amid position-building operations from investors in small and medium stocks, which had dropped to attractive buying prices. The transactions of Arab and foreign investors leaned towards selling, while Egyptian investments recorded a net purchase of about 116 million pounds.