Afghanistan is reeling on the edge of a severe economic, living, and social abyss since mid-August. In the early weeks following the withdrawal of the last U.S. troops, a liquidity crisis struck its already weak economy due to the freezing of central bank reserves in the United States, forcing some local companies to close and banks to limit withdrawals.

**Over $9 Billion Frozen**

As the U.S. and several European countries refuse to recognize the Taliban as a legitimate authority—fueled by concerns over its ties to terrorism and human rights violations—the new rulers have lost access to more than $9 billion in central bank reserves. This occurred after the Biden administration froze assets held in U.S. banks, and other nations followed suit. Additionally, funding from the World Bank and the International Monetary Fund has been suspended, leading to a crushing liquidity crisis in the country.

**Workers Without Salaries**

The lack of available funds, coupled with border restrictions and growing international isolation aimed at forcing the militant group to concede to demands for human rights and counterterrorism measures, has pushed thousands of workers into poverty, while others have been deprived of their salaries. In some cases, this situation has led a number of children to engage in smuggling operations at the borders.

**Separation from the Outside World**

Moreover, the crisis threatens to sever Afghanistan from the outside world, according to Bloomberg. Wireless telecom companies are struggling to pay their suppliers.

**Food Shortages**

The repercussions of the liquidity crisis are particularly concerning, with the potential for worsening food shortages and rising prices of essential goods, signaling the onset of a far more serious and widespread economic and humanitarian crisis. For over 20 years of U.S. presence, Afghanistan’s economy relied heavily on international aid and the U.S. dollar, which was circulated alongside the local currency and routinely used for paying for imported goods and services as well as larger transactions like purchasing homes or paying private school tuition.

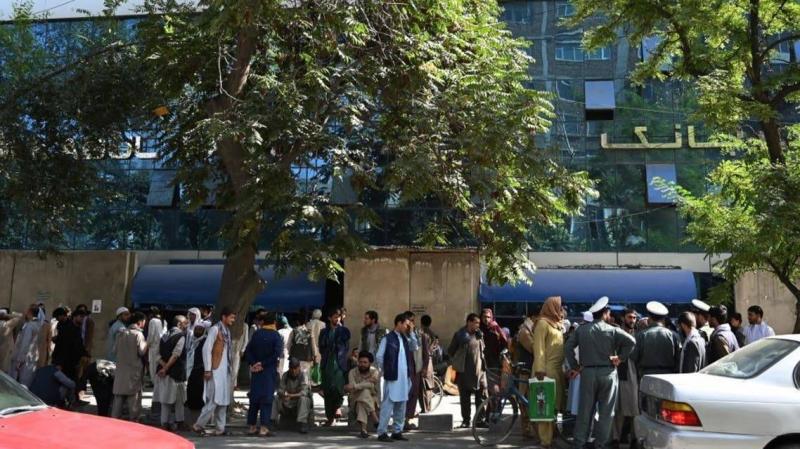

In this context, Shah Mehrabi, a board member of the Afghan central bank currently in the U.S., estimated that about two-thirds of the deposits in the banking system and half of the total loans are in dollars. He also confirmed to Bloomberg that "dollarization remains prevalent in Afghanistan," saying, "Our economy relies on it." To maintain the little remaining reserves, the Taliban has resorted to capital controls, including preventing Afghans from taking dollars out of the country and limiting bank withdrawals to $200 per week.

**Crisis Worsens**

In light of these realities, the liquidity crisis in the country worsens, as does poverty. The dire conditions have prompted some Afghans to sell household essentials in the second-hand markets in Kabul. Ahmed Khosrow Dya, the former CEO of the Oldest Afghan Bank - now an economics professor at a university in Kabul - stated, "The liquidity crisis is worsening, and many banks are unable to pay depositors."

Many observers do not anticipate that Washington will soon release Afghan central bank reserves, while the United Nations warns of deteriorating living conditions in the country and a dramatically escalating refugee crisis!