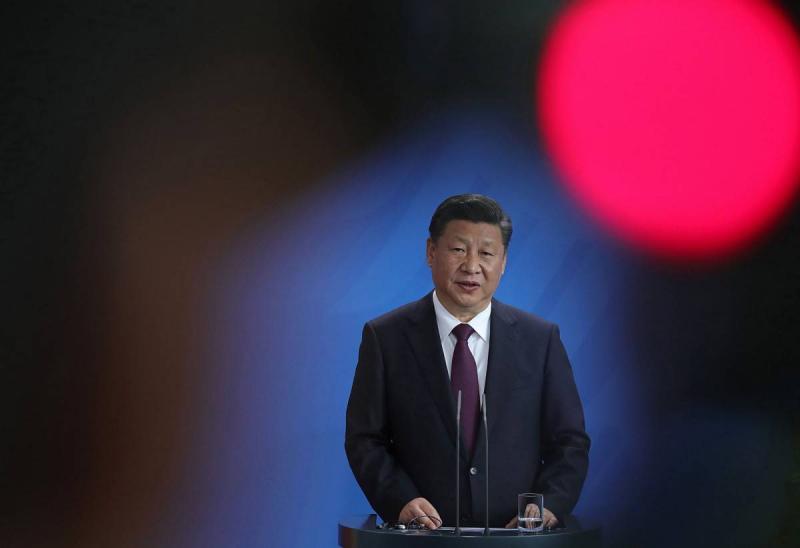

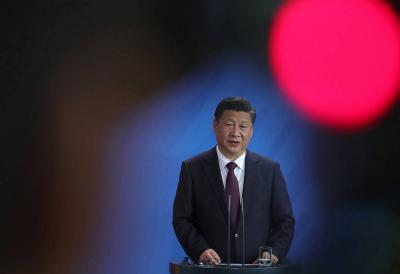

Chinese President Xi Jinping announced that China will establish a new stock exchange in Beijing to provide financing for innovative small enterprises, as part of efforts to increase the role of equity financing in China's financial system. President Xi did not specify a date for the formation of the new exchange's board or any other details, but he mentioned that the step "will provide a platform for innovative small and medium-sized enterprises." In a speech delivered yesterday in the Chinese capital, he stated that there would be a "reform" of the National Equities Exchange and Quotations Co., an existing stock exchange based in Beijing that was opened in 2013. Beijing has expressed its intention to increase the share of equity financing in its financial system, which is heavily dominated by banks, as part of a campaign to reduce debt levels in its economy. In 2019, China launched a new stock exchange in Shanghai known as the STAR Market to provide more financing for technology companies.

The China Securities Regulatory Commission stated in a post-speech announcement, "Deepening the reform of the Third New Board and establishing the Beijing Stock Exchange is an important move to implement our national strategy for innovation-driven development and to continue developing new growth engines." The statement also noted that this is also an important move to deepen the structural reform of the financial supply side. The "Third New Board" is another name for the National Equities Exchange and Quotations.

Xi did not comment on any of the recent regulatory actions by the government, which are part of a broader campaign recently undertaken to rein in internet platforms and educational companies that have shaken financial markets in recent months. During the speech at a government-led summit on trade in services, Xi emphasized China's gradual openness to foreign investment in service sectors such as finance and healthcare, as Beijing sees the introduction of foreign competition as a key part of modernizing its economy. In this context, Xi stated that China will continue to open services by "exploring" the establishment of an innovation zone dedicated to trade in services and by implementing a nationwide "negative list." China has previously issued such lists to designate sectors that are banned from investment while allowing investments in other areas.

Additionally, President Xi stated that "China is ready to work with all parties to continue open cooperation," noting that the country "will engage in opportunities for the development of service trade to promote the recovery and growth of the global economy." The collapse of international tourism, which declined globally due to the pandemic, has impacted global trade in services. China’s imports and exports of services fell 15.7% year-on-year to 4.6 trillion yuan (712 billion USD) in 2020, primarily due to the sharp decline in tourism, according to official figures.

Since Chinese tourists spend much more abroad than foreign tourists spend within China, the country has been facing a persistent deficit in service trade, exceeding 1.5 trillion yuan in 2019. This deficit has contracted in recent years due to the rapid growth of service exports, partially due to the international success of technology companies like ByteDance, the owner of TikTok. China strictly restricts foreign companies' access to certain sectors like digital services, effectively banning foreign social media platforms like Facebook from serving consumers in the country. Beijing has more restrictive policies in service trade than the average observed within the Organisation for Economic Co-operation and Development (OECD), according to an index compiled by a club primarily consisting of wealthy economies. However, China has strategically opened up some sectors in recent years, experiencing one of the largest declines in service trade restrictions of any country since 2014, according to the OECD.