The wave of consumer spending has helped the U.S. economy gain additional growth at the beginning of the year, unlike Europe, where recovery from COVID-19 remains sluggish. Manufacturing in Japan remains strong despite headwinds from global chip shortages and government measures to combat the pandemic. Here are several graphs on the latest developments in the global economy:

**United States**

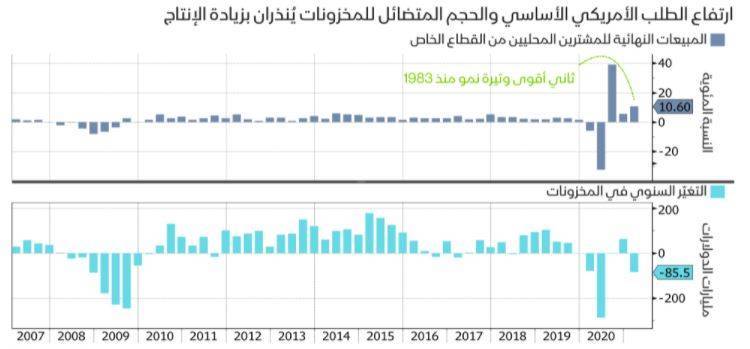

Retail sales to local private buyers recorded the second strongest growth since 1983, at 10.6%, a key measure of U.S. demand in the preliminary government estimate of GDP for the first quarter. This signals, alongside dwindling inventory levels, that output will continue to grow until the end of 2021. Thanks to stimulus packages and financial aid from the federal government, personal income jumped by more than 21% in March, providing Americans with additional spending power. Forty years ago, U.S. President Ronald Reagan and Federal Reserve Chairman Paul Volcker oversaw a radical restructuring of the American economy. Today, President Joe Biden and Federal Reserve Chairman Jerome Powell are trying to do the opposite, as Biden reaffirms the role of government spending and taxes in the economy. This is first through the $1.9 trillion stimulus bill approved in March and recently through a proposal to spend over $4 trillion on public investments and infrastructure.

**Europe**

The eurozone entered a double-dip recession in the first quarter, highlighting the economic cost of slow vaccination campaigns against COVID-19, which have left the economy significantly lagging behind the U.S. The population density in London is one reason for the rapid spread of COVID-19, resulting in higher mortality rates in Britain than in other countries. Britain, especially in areas like East London, is denser than countries like New Zealand and Sweden, which are witnessing fewer deaths.

**Asia**

Measures of manufacturing and services in China declined in April, indicating that the economy is still on the path to recovery but at a slower pace. Japanese factory output unexpectedly rose in March, suggesting greater resilience in coping with the emergency and chip shortages. This has helped manufacturing companies perform significantly better than initially expected in the first quarter of 2021.

**Emerging Markets**

All eight Asian emerging economies, including India and Indonesia, are expected to see interest rates stabilize in 2021, according to average forecasts from economists in Bloomberg surveys. The drought in South America, which has contributed to rising corn and soybean prices for several years, threatens not only the crops but also the ability to transport goods through increasingly drying waterways. According to the "Bloomberg Economics" model, which estimates fair currency values based on economic fundamentals, currencies of emerging markets are considered the most underpriced.

**Global Economy**

According to research by "Bloomberg Economics," data from the markets and companies over 30 years have shown that the largest companies in the world are performing well, but this may not be good news for everyone. One indicator of the increasing power of giant corporations is their rising ability to withstand taxation, with the average effective tax rate for the largest companies in the world halving from 35% in 1990 to 17% in 2020, reflecting the combined impact of lower tax rates and aggressive tax reform strategies. The COVID-19 pandemic has had a significantly greater economic impact on women, who are prominently represented in the industries hardest hit by the pandemic; globally, women lost at least $800 billion in income in 2020, according to estimates by Oxfam International. A report by the OECD indicated that the economic disruption caused by the pandemic and growing concerns about health and financial matters are fueling demand for increased government spending in most wealthy countries, despite public awareness that this may mean higher taxes.