The three Turkish ships docked in Lebanon provide floating power stations equipped with the best technologies, generating between 35% and 40% of the country's electricity. The contract between the Lebanese state and the company "Karadeniz" will end in September, as the Lebanese side struggles to pay dues exceeding $100 million in arrears from last year, which the company has demanded to be paid in dollars or they will withdraw. The issue of Turkish ships has become a major point of contention among political factions in Lebanon, with a sharp division in viewpoints regarding their continuation or the call to terminate the contract.

Recently, the situation in Beirut has escalated, as Turkish energy ships were detained amid corruption allegations. On Wednesday, the Lebanese authorities decided to detain the Turkish ships supplying the country with electricity to investigate suspicions of corruption amounting to millions of dollars, but the decision does not constitute a conviction as of now. The financial prosecutor, Judge Ali Ibrahim, ordered the seizure of the ships and prevented them from leaving Lebanon. Various ministries and security agencies, including the army, were requested to implement the decision.

On Thursday afternoon, Judge Roni Shahadeh in Beirut approved the release request for the main detainees, Fadel Raad and Ralf Faisal, involved in the renting of the power-generating ships, against a financial bail of $1 million for Raad and $700,000 for Faisal, or an equivalent in Lebanese pounds.

There are indications of bribery in the ship case. Commenting on the issue, Lebanese MP Hadi Habib told "Sky News Arabia" that what happened was a significant achievement through investigations, awaiting further details to understand where things will lead, especially in this contentious political issue. He noted the role of the media and the judiciary in the seizure decision as confirmation of irregularities in this case, suggesting signs of bribery that must be exposed.

The urgency of the investigation is critical. International law professor and head of the "Justicia" rights organization, Paul Marqous, stated to "Sky News Arabia" that while the judicial decision meets the Lebanese people's need to combat corruption, it remains abstract without solid evidence due to the prolonged investigations. There is a fear that commercial and service ships, especially Turkish ones that supply electricity, might be deterred from engaging with Lebanon due to potential arbitrary measures, even if precautionary.

He added that the financial prosecutor should urgently complete the investigations and refer the case to the judiciary without delay, allowing the concerned ship to lodge a guarantee deposit at an acceptable bank, enabling it to sail and preserve Lebanon’s reputation and rights simultaneously.

The cost of renting the ships exceeded $4 billion. Writer and economic analyst Khader Hassan explained to "Sky News Arabia" that Lebanon rents the ships from the Turkish company Karadeniz due to a tender that was not conducted within the right legal frameworks, costing approximately $850 million annually for a project extending over five years, meaning the state pays about $4.25 billion, exceeding the cost of building more than one power plant.

He added that while the ships were originally intended as a temporary solution, they have become a semi-permanent solution due to the corruption indicated by the bribery and money laundering case involving Fadel Raad and Ralf Faisal, who are merely fronts for more powerful stakeholders.

Hassan opined that given the succession of legal and financial scandals related to the ships, the Lebanese judiciary can no longer ignore them due to political decisions. Financial prosecutor Ali Ibrahim has prevented the two Turkish ships from leaving Lebanon until the investigations regarding Faisal and Raad's case are concluded, as confirming the accusations would mean the Turkish company must pay $25 million according to a penalty clause, confirming that the company has not provided evidence to the contrary.

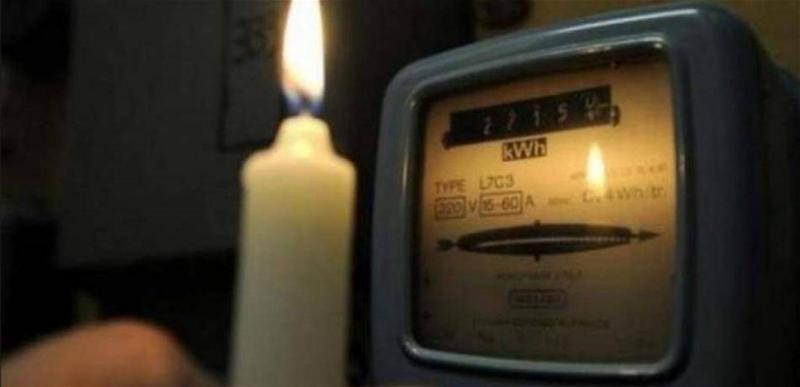

He added that prior to the scandal's expansion, the company demanded more than $100 million in dues from the state, and the ship crisis is intertwined with the broader energy crisis in Lebanon. The deficit of Electricité du Liban has surpassed $40 billion, straining the public treasury. The state purchases fuel derivatives for the struggling institution at a cost of $1.2 billion annually, with the ships taking a portion of these fuel derivatives. In contrast, citizens endure increasing power cuts, aggravating the cost of private generator bills.

He pointed out that 55% of the electricity deficit is due to energy waste between aging production plants and deteriorating distribution lines. The institution remains in deficit while it collects annually between $650 million to $750 million, with total expenses ranging between $150 million and $200 million annually.

He concluded that due to the economic and monetary crisis in Lebanon, the state can no longer secure dollars to purchase fuel or conduct maintenance on production plants, putting the country at risk of total darkness unless the political authority finds a suitable solution.