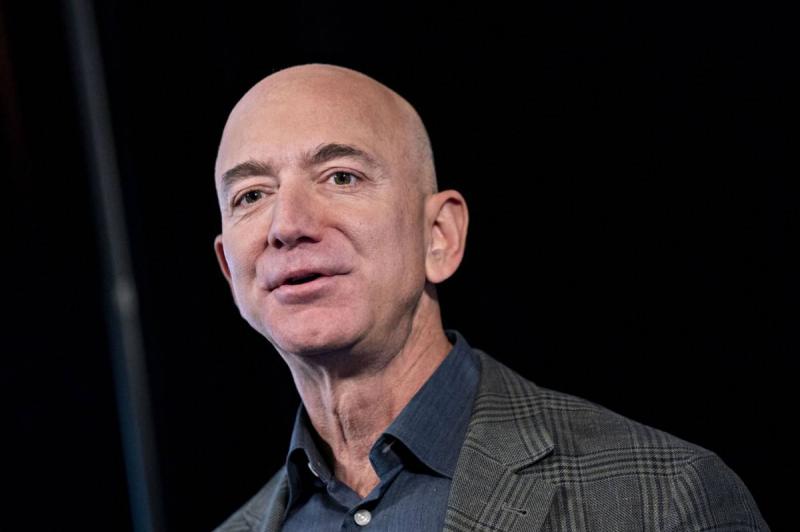

Space investors like Jeff Bezos share an eagerness for exploring science fiction reminiscent of the 1970s. However, current investors are more convinced than their predecessors that humanity's future is linked to the stars. One key difference is that those in the '70s did not have over $200 billion in wealth and a rocket ship that will take the world's richest person beyond the Kármán line on Tuesday. Additionally, they benefit from the support of "Robinhood" traders, who drive them to further success through the purchasing of space-related stocks and securities.

#### A $1.4 Trillion Industry

Exchange-traded funds, startups, and new trading technologies have made betting on the future of the economy beyond Earth easier than ever. Bank of America estimates the space industry's value at around $415 billion, with the potential to grow to $1.4 trillion by 2030. The news of Bezos's upcoming flight on Tuesday, alongside fellow billionaire Richard Branson earlier this month, has drawn investors' attention to what lies beyond their journeys. Cathie Wood, a leading investment manager, launched the "ARK Space Exploration" ETF in March, marking the first new ETF introduced by the firm in two years, tracking companies involved in space exploration and innovation. It successfully attracted over $600 million in assets upon its debut this year.

Earlier this summer, satellite launch services company Astra Space Inc began trading on the NASDAQ following its merger with the SPAC Holicity Inc. Other companies, like launch company Rocket Lab USA Inc and infrastructure firm Redwire, also announced their intentions to go public. All this aligns with the excitement of individual investors convinced of the potential of space discoveries.

#### Science Fiction as a Starting Point

Alex Greenfield, a 48-year-old screenwriter and new space investor living in Mount Snow, Vermont, states, "It may be hard for people my age to go to space, but I could help the industry. Works like Star Wars and Star Trek played a significant role in shaping this pop culture, which excited me." Greenfield began actively investing last year via the Robinhood trading platform amid the COVID-19 pandemic. Unlike many Americans, his first move to enter the market came while he was watching the sci-fi series "Westworld" and imagining what it would take to build a robot. Eventually, that led him to space.

He invested $500 in January into the $120 million "ProShares ETF" focused on companies deriving the majority of their revenue from space-related industries. Greenfield reinvested an additional $150 during a market dip and later acquired $500 worth of shares in the Woods ARK ETF after its launch, boosting his total investment to about $1,000 this summer. He recognizes that investing in space requires boldness and sentiment, but he hopes new technologies that may not initially seem space-focused could advance this sector. He is particularly optimistic about 3D printing in space, which could significantly reduce the cost of transporting goods necessary for building human environments on other planets. Greenfield says, "Some will invest the right funds in a new trillion-dollar startup, and their children will be the Carnegies."

#### Huge Growth Opportunity

This long-term vision aligns with some financial advisors' recommendations regarding the space industry and their beliefs in its potential. Noah Damsky, founder of Marina Asset Management based in Los Angeles, says, "It's a huge growth opportunity in ways we can't even imagine, like Bitcoin years ago when it was something we could hardly comprehend." Ryan Grizer, a financial planner at Opulus Consulting in Doylestown, Pennsylvania, notes that entering an emerging sector early can enhance overall portfolio returns. Grizer believes that the convergence of various technologies could present an opportunity, as it may accelerate trends that could make space travel more profitable. These include the convergence of space technology with artificial intelligence, robotics, 3D printing, and sensor chips.

#### Expected Risks

However, risks loom on the horizon, and rockets could fail. The U.S. Securities and Exchange Commission filed a lawsuit on July 13 against the space shipping company Momentus and the SPAC Stable Road Acquisition, accusing Momentus of misleading practices regarding its technology and claiming its payment system had been "successfully tested" in space. The SEC noted Stable Road Acquisition's repeated misrepresentations in Momentus's registration statement without verification.

Financial advisors also warn that the space sector is emerging, hence the likelihood of volatility and losses is high. For instance, Branson's Virgin Galactic Holdings has seen its stock decline on every trading day since its space flight, erasing all its gains since early June, leading space ETFs to continue suffering losses over the past two months.

Investors differ on the nature of investing in space. Some were surprised by the Woods ARK fund's investments in stocks like Netflix, Amazon, Alphabet, and even Deere, the large agricultural tractor manufacturer. Kyle Walton, a 30-year-old industrial engineering graduate from Wichita, Kansas, who manages a Facebook group for space investing and has about $2,000 in the ARK Space Exploration fund, remarks, "We've made a lot of memes and jokes about John Deere."

#### Space-Linked Investment Strategy

Walton refers to giving the ARK Space Exploration fund another year to see if his doubts about space investment are validated, while emphasizing his preference for the ProShares Space ETF, which he believes has more exposure to the sector due to stricter requirements on space-related investments. Walton invests around $3,700 in ProShares Space.

Todd Rosenbluth, head of ETF research at CFRA, states, "There are many ways to implement a space-linked investment strategy. The ARK Space Exploration fund has applied a broader strategy to explore companies that may be related to the sector, which includes less obvious firms." For example, regarding John Deere, it's unlikely the company will be launching tractors into the skies anytime soon. However, it has collaborated with NASA's Jet Propulsion Laboratory to develop self-driving tractor technology and invests heavily in GPS and drones, which predominantly have space applications.

Much like in other industries, consumer-dominant companies might make headlines, with Virgin Galactic planning to start transporting passengers to suborbital space next year at over $250,000 per seat. Yet companies that operate away from the spotlight and focus on their business activities have the potential to generate massive profits. Tis Hatch, a partner at Bessemer Venture Partners focusing on space investment, concludes, "Space tourism gets a lot of talk, but this economy includes an entire sector comprising rockets, satellites, communication infrastructure, and satellite manufacturing—essentially, the things that will make daily life possible in the future Galactic Empire."