The automotive sector has suffered a severe blow due to the semiconductor supply shortage, leading to slowed production and factory shutdowns, although improvements may be seen by late 2021. Automotive companies and their suppliers reported better-than-expected results for the first half of the year but indicated that the chip shortage hindered production processes. Since the end of 2020, it has become difficult to find these electronic chips essential for car assembly. As consumers resumed buying cars, Mercedes and BMW had to temporarily suspend operations at several of their plants. Jaguar Land Rover warned that the shortage could lead to a halving of its sales in the third quarter. On Thursday, Volkswagen stated that the likelihood of semiconductor supply disruptions "has increased in the automotive sector." The CFO of the German group, Arno Antlitz, explained, "We have managed to mitigate the consequences of this shortage so far, but we expect clearer impacts in the third quarter." As a result, Volkswagen has lowered its sales expectations.

Additionally, Ford temporarily closed some of its factories. However, the group benefited from strong demand for its cars and trucks "to improve revenues and profits" by cutting promotional offers and focusing on more profitable vehicles. The average price of its vehicles in North America rose by 14% year-on-year. For its part, Nissan postponed the launch of its fully electric Ariya due to the chip shortage, but it did not alter its annual sales target. Tesla, which is hindered by a shortage of airbags and particularly seatbelts, has designed programs to use new components, as stated by its CEO Elon Musk.

Will this "chip" shortage (dubbed "Chipageddon" by the English-speaking media) resolve in a few months, or will it persist? Ferdinand Dudenhöffer, director of the Automotive Research Center, told AFP, "We have reached the peak of the crisis. The situation will improve once new production capacities become available, but the problem will not be resolved by the end of 2021 and may continue until 2023. There will be ongoing risks in the supply chain." The expert predicted that the shortage could lead to a production decline of 5.2 million cars this year and a sharp drop in registrations in the second half of the year, with longer wait times and higher prices for buyers. Dealers have sold out their inventory and will have to gradually rebuild it. This shortage also impacts the used car market, which sees rising prices with increased demand.

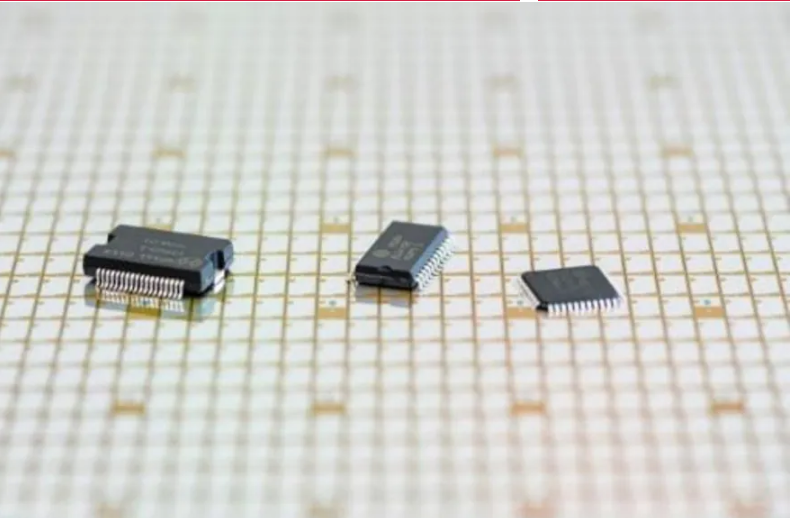

Valeo, an equipment manufacturer using 50 billion electronic components annually, has currently managed to avoid hindering its production process by sourcing components from its better-equipped factories, for example. The company's CFO, Robert Charvier, stated, "Whenever we find electronic components, we buy them and stock them." Valeo also sees the crisis easing but expects it to continue into 2022.

Supply Chain Review

In this sector, where logistics are meticulously accounted for, "car manufacturers and equipment suppliers are reassessing their supply chains to better control them, diversifying sources if possible," according to Niels Boll from the European Equipment Manufacturers Association. He confirmed that "some car manufacturers are coordinating better with their suppliers, while others are pressing them." Matilde Aubry, an economics professor at EM Normandy Business School, noted that the automotive sector could "perform better" than others and predicted, "It likely won't be the sector that suffers the longest."

The U.S. government plans to invest $52 billion to reduce its reliance on Asia. Aubry explained that Europe is now trying to bring most of the smaller chips home, as they are crucial in "super-strategic sectors related to health and security." Dudenhöffer indicated that the sector should be wary of another shortage: with the unexpected sharp rise in electric vehicle sales since 2020, battery units could start running low as early as 2023.