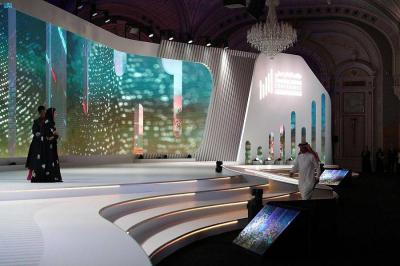

The second edition of the Financial Sector Conference concluded in Riyadh, amid optimism about overcoming market challenges by building a robust and sustainable economy driven by technology in the future. The conference sessions saw the participation of 3,200 attendees, including many representatives from major global financial institutions and finance ministers, listening to over 100 speakers discussing mechanisms for creating a clear roadmap to achieve growth and prosperity for the financial sector in the future. The sessions addressed the future of the global financial community under the theme "Promising Financial Horizons" by enabling technology, diversifying investments, and enhancing international cooperation for a green economy.

In a closing speech at the end of the conference, the Governor of the Saudi Central Bank, Ayman Al-Sayari, emphasized that the conference is part of the support and development of the financial sector, providing an enabling environment, promoting financial technology, and enhancing human capabilities in this field. He noted that companies operating in the financial sector play a crucial role in elevating and developing national competencies, representing an important factor in contributing to the maturation of talent, especially amid the rapid sector development.

He explained that the central bank's efforts, along with its partners in the Financial Sector Development Program, continue to empower financial institutions to support private sector growth, contribute to national economic growth, diversify income sources, and stimulate saving, financing, and investment. The goal is to provide an attractive environment for emerging financial technology companies, aligning with developments in the local and global economy to enable businesses to innovate and invest in the financial technology sector, while also highlighting the insurance sector in the Kingdom, which is a promising sector experiencing rapid growth. He asserted that the efforts of program partners will, God willing, contribute to making it a sustainable and prosperous sector, enhancing its participation in the GDP.

On the second day, conference sessions discussed financing the small and medium enterprises sector with its significant regional and international growth. In a panel session focused on shaping the future of global capital flows, Bahrain's Minister of Finance and National Economy, Sheikh Salman bin Khalifa Al Khalifa, stated that traditional banks need to transform to adapt to the new reality and view it as an opportunity for future growth, highlighting the current challenge of how to establish systems and regulations for the future. Egyptian Finance Minister Mohamed Maait participated in this session, noting that digitization and innovation in the financial sector aim to facilitate faster and more efficient movement of funds, which should be approached carefully with advanced regulations to avoid potential negative impacts.

The CEO and board member of the Saudi Venture Capital Company, Nabil Koushki, confirmed that the Kingdom's interest in developing entrepreneurship stems from objectives set within the framework of Saudi Vision 2030, funding programs, and updating policies and regulations in the financial ecosystem, which have positively impacted this sector's prosperity and its contribution to the main and parallel financial markets in the Kingdom.

On the sidelines of the conference sessions, several real estate projects were announced, including those by Al Jazeera Capital and Mohammed Saad Al-Ajlan Real Estate Company, which signed agreements for the launch of projects such as Al Jazeera and Al Malqa, as well as Al Ajlan Real Estate Fund. Additionally, Bayt Al-Mal Al-Khaleej and Bandar Real Estate Company signed a separate agreement to establish a real estate fund in the Eastern Province, and Sedco Capital launched a real estate development fund.

The conference witnessed FinTech Saudi signing four memorandums of understanding with the National Center for Government Resources Systems, Aramco Entrepreneurship Center, Visa, and FIS, significantly contributing to enhancing the importance of the financial technology sector on both regional and global levels. Visa and Al-Inma Bank also signed an agreement to launch innovative payment solutions in financial technology, while Tamara, a payments company, announced its first regional deal with Goldman Sachs by securing debt financing of up to $150 million. It is noteworthy that the 2023 Financial Sector Conference is the second edition of this conference, organized by the partners of the Financial Sector Development Program, which includes the Ministry of Finance, the Saudi Central Bank, and the Capital Market Authority, and is part of the Financial Sector Development Program in the Kingdom, considered a key component of Saudi Vision 2030.