The Executive Office for Anti-Money Laundering and Combating the Financing of Terrorism (AML/CTF) has concluded a preliminary program with Her Majesty's Revenue and Customs (HMRC) in the United Kingdom, aimed at enhancing protocols designed to identify and address money laundering practices while halting the flow of money and goods through illegal means.

The two-week program included representatives from law enforcement and regulatory agencies in both the UAE and the UK, with meetings hosted by the Executive Office for Anti-Money Laundering and Combating the Financing of Terrorism in the UAE. The meetings featured representatives from HMRC and the Special Operations Community Network (SOCNet) from the UK, while the participating Emirati entities included the Ministry of Interior, the Central Bank of the UAE, the UAE Financial Intelligence Unit, the Ministry of Economy, the Ministry of Justice, and the Federal Customs Authority.

This cooperation program builds on fruitful international government conferences held in November 2020, as well as subsequent specialized workshops, according to the Emirates News Agency (WAM).

In addition to risks involving common threats such as trade-based money laundering, illegal smuggling of funds and gold, and exploitation of regulated businesses such as exchange companies, the program enhances the commitments of both the UK and the UAE to build the necessary technical expertise and strengthen their respective information, investigation, and oversight systems.

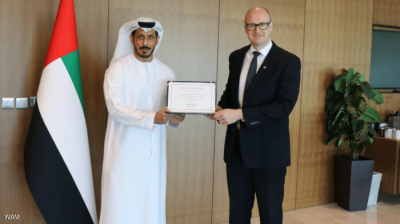

Hamed Al Zaabi, Director General of the Executive Office for Anti-Money Laundering and Combating the Financing of Terrorism in the UAE, stated that “cooperation with HMRC enhances expertise and contributes to addressing common challenges, as international financial and commodity centers by continuing to work and closely collaborate, enhance the effectiveness of efforts to combat corruption, organized crime, and terrorism financing."

For his part, Kevin Newey, a representative of HMRC, noted that the efforts of the Executive Office for Anti-Money Laundering and Combating the Financing of Terrorism "have strengthened the UAE's role in addressing illicit financial flows." He added, "We look forward to continuing to enhance cooperation with our partners in the UAE and the Executive Office for Anti-Money Laundering and Combating the Financing of Terrorism."