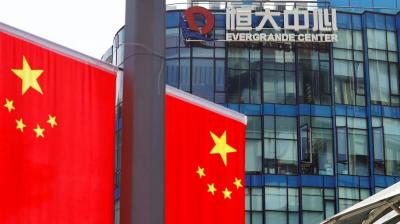

Chinese property developers are now responsible for about half of the distressed dollar bonds in the world, indicating the magnitude and nature of the industry's problems. Among the $139 billion in dollar-denominated bonds trading at distressed prices, 46% were issued by companies in China's real estate sector, according to data collected by Bloomberg on October 12, the highest above their benchmark rates.

In another sign of declining investor confidence, demand for Chinese dollar bonds fell in September, as liquidity issues for China Evergrande Group weighed on the primary market for external debt. Despite over 24 hours passing without any clarification on whether the embattled developer Evergrande made interest payments due on October 11 for three of its dollar bonds, there is a 30-day grace period before any missed payment constitutes a default. The next test for Evergrande’s credibility with investors will be on October 19, when a domestic bond interest payment of 121.8 million yuan ($18.9 million) is due. It will then need to deliver coupon payments on dollar securities on November 6.

Key developments:

The debt crisis in China continued to expand, with Moody’s lowering the rating of Sinic Holdings Group to Ca from Caa2 after announcing on Monday the likelihood of default. This follows three weeks after Moody’s placed the Chinese developer under review for a downgrade. Sinic stated that it does not expect to pay the principal and the final interest payment due on October 18 for a $250 million bond.

On the other hand, Fantasia Holdings Group, one of the Chinese property developers, formed a team to restructure its debts and internal assets, according to a post on the WeChat platform. The post stated that the team "will coordinate the restructuring of the group’s debts and assets and will address liquidity risks."

Some bonds for Chinese developer Yango Group Co continued to collapse on Wednesday, even after last week’s denial of social media reports that a residential project had been halted. Meanwhile, Shimao Group Holding deposited funds into the trustee’s bank account to fully redeem bonds on October 15, with a principal due of $820 million, and interest due until the maturity date, according to a stock exchange filing.

Auctions Frozen

Beijing postponed auctions for 26 plots of land while the city of Hangzhou canceled bids for 17 plots this week amid government efforts to stabilize the housing market, according to Securities Daily. The newspaper, citing unidentified research institutions, reported that the real estate market is facing cooling pressures in the fourth quarter as government property control policies remain tight. The report indicated that most developers have become more cautious in the bids they submitted in the second half of this year amid bleak financing prospects and overall shrinking margins in the sector.