Under the title "Unifying Exchange Rates," Al-Hurra published an article about the exchange rate of the Syrian pound against the dollar, noting that amidst the worst economic and financial crisis Syria is experiencing, there has been an increase in circulars and decisions aimed at controlling the rampant dollar exchange rate. The latest of these decisions is the banks and exchange rate bulletin.

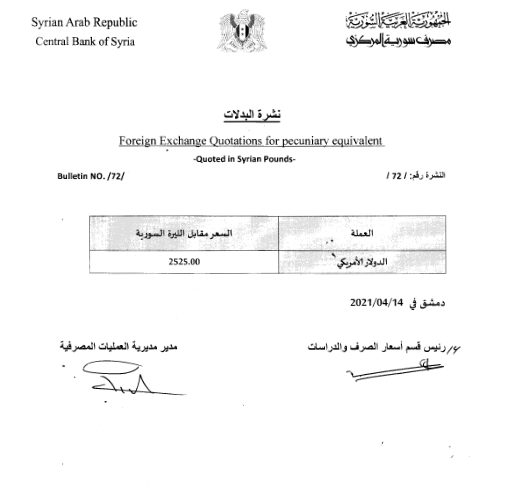

The Central Bank of Syria adjusted the banks and exchange rate bulletin, setting the purchasing price for remittances from abroad, whether personal or through Western Union, that are for the benefit of the United Nations and its affiliated bodies and humanitarian organizations, at 2500 Syrian pounds per U.S. dollar, up from 1250.

This adjustment is part of the bank's effort to "unify exchange rates and encourage external remittances through systematic channels to achieve an additional foreign currency source directed to serve the public interest," according to the bank statement. Local sources indicated to Al-Hurra that despite the official exchange rate (2500 SYP/USD), some exchange companies delivered remittances from abroad at the equivalent of 3050 Syrian pounds per dollar, while the dollar exchange rate in the black market reached 3175 Syrian pounds on Saturday.

Given the narrowing gap between the exchange rate set for remittances and that practiced in the black market, questions arise regarding the purpose of this move and its viability.

In response, economic analyst Younes Al-Kareem told Al-Hurra, “The Central Bank is trying to stabilize the dollar price, especially since remittances are the main source of foreign currency.” He confirmed that “some offices adopted a higher price than officially set.” Al-Kareem argued that this step serves as an “attempt to attract Syrians abroad to send their money through exchange offices and remittances instead of through the black market, especially since the difference is no longer significant between the two.”

He explained that “industry is completely halted, and the real estate market is stalled due to the absence of a sales law that would impose tax on property prices, which has made external remittances the only outlet for obtaining foreign currency and for potential imports again, something the government is striving for after the crisis of scarcity of essential goods in the markets.”

The economic analyst highlighted that “the Syrian government is unable to import essential goods due to the loss of all budget funds after the significant and ongoing collapse of the exchange rate.” He emphasized that the Central Bank's move is not aimed at funding the Syrian regime, stating, “Today’s priority is to secure essential goods and services for the people.”

The country is preparing for presidential elections, the second since the outbreak of the Syrian crisis in 2011, in the coming months, although no final date has been set yet. In this context, economic journalist Murshid Al-Nayef mentioned to Al-Hurra that “the goal of Bashar al-Assad's regime in devaluing the Syrian pound is to provide minimal supplies of foreign currency, as Syrian markets are suffering from a significant drought in dollars.”

He added, “The regime wants to shift all economic burdens and responsibilities to the exchange rate to divert attention from other more important issues, as there is a severe shortage of oil derivatives and bread,” pointing out that “there is a clear attempt to reduce and confine the economic and living crisis to the exchange rate.”

Al-Nayef considered that “what the Central Bank announced is not an 'achievement' but rather an acknowledgment of the collapse of the pound and its official depreciation against the dollar,” clarifying that “the regime has no other option but to raise the exchange rate; it seeks a lifeline after it lost all traditional foreign currency sources that stabilize dollar movement, especially since Lebanon is also facing a similar economic and financial crisis.”

Regarding the propriety of the step scientifically, Al-Kareem expressed his lack of hope that unifying the exchange rate would have positive effects on the Syrian economy. However, Al-Nayef asserted that “this measure is temporary and will not lead to any recovery of the Syrian pound's exchange rate, even if it brings some benefits to the government and Syrians sending money to their relatives from abroad,” emphasizing that “the economic reality requires supportive growth policies.” The Central Bank of Syria had previously raised the official exchange rate of the pound against the dollar from 700 to 1250 pounds in June 2020.